Special Offer on ADT Home Security

Help on Buying a Home

How much can you afford?

Examine your budget. Complete our Budget Worksheet. Our one-page worksheet will quickly guide you to compare your net monthly income (what’s deposited into your checking account) with your actual monthly expenses – i.e. student loans, car payments, credit cards, utilities, insurance, gas, groceries and other expenses. Quickly analyzing your actual budget will help you to determine the monthly housing payment you can afford.

Hire a pro

Work with a friendly and knowledgeable Realtor®, someone who is highly rated and reputable in the community you’re considering. Your Realtor® will identify homes in your price range, room count, living area specifications, location and which include the key features you’ve prioritized for your home. It’s best to work with an agent with extensive experience, preferably an agent with educational certifications such as, GRI or CRS.

Define your goals

Determine if you want an existing home or if you want to buy or build a new home (new construction). Narrow your search: Focus on homes in areas you already know and like. Don’t let excitement about "seeing that dream home" become a temptation to buy beyond your budget.

Buy with your head, not your heart

Think clearly and rationally. Bring a parent or experienced buyer along. You may find a perfectly charming home, but if it’s located in a high-traffic area, or 45 minutes from schools, shopping or other daily amenities, you may struggle to resell that home in the future and lose money.

Research before you buy

Research school ratings, real estate tax rates, home owner association or local government issues and investigate crime activity in the neighborhood you’re considering. Also view law enforcement websites that may list information on crime rates, or list sexual predators in the area.

Consider the costs

Ask about all the costs associated with a particular home. For example, ask for a copy of the most recent real estate tax bill, insurance bill, or home utility bills. Ask if there are association fees or special assessments. Are improvements required? Be sure to budget for repairs before you buy.

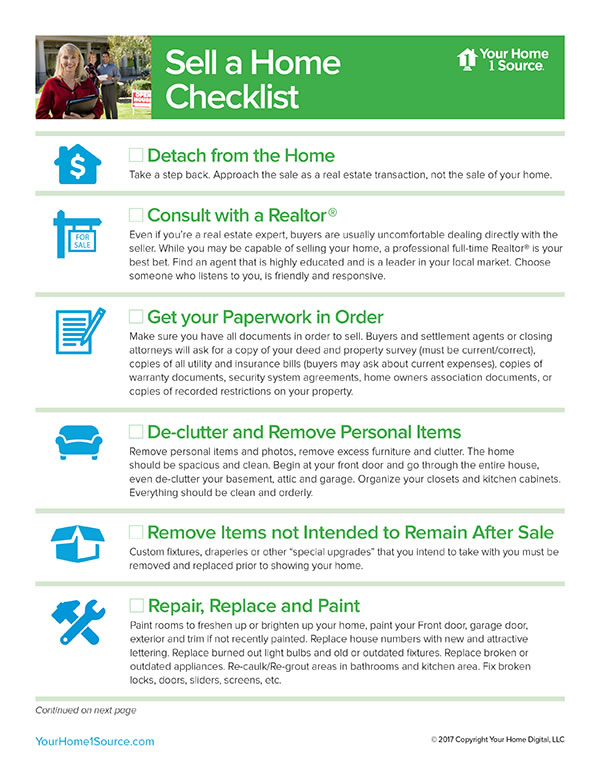

Help on Selling a Home

Detach from the home

Approach the home sale as a real estate transaction, not the sale of YOUR home. Sellers often place a higher value on their home than others would. Ask two or three top Realtors® in your community to provide a market analysis based upon closed-sale data of similar homes nearby. Average these professional assessments for the real value.

Consult with a Realtor®

Even if you’re a real estate expert, buyers are uncomfortable dealing directly with the seller. While you may be capable of selling your home, a professional Realtor® is your best bet. Find an experienced agent who is known to be a leader in your community. Choose an agent who listens to you, is friendly and responsive.

Get your paperwork in order

Make sure you have all documents in order to sell. Buyers and settlement agents will ask for a copy of your deed, property survey (must be current/correct), copies of all utility and insurance bills (buyers may ask about current expenses), copies of warranty documents, security system agreements, and copies of recorded restrictions on your property.

De-clutter/remove personal items

Remove personal items and photos, remove excess furniture and clutter. The home should be spacious and clean. Begin at your front door and go through the entire house, even de-clutter your basement, attic and garage. Organize your closets and kitchen cabinets. Everything should be clean and orderly.

Remove items that are not for sale

It’s important to remove custom fixtures, draperies, expensive ceiling fans or other items that you intend to take with you. Once a prospective buyer sees such items in your home, they will expect those items to remain in the home following closing. Misunderstandings can cause tension, lead to a withdrawn offer, or end in legal proceedings.

Repair, replace and paint

Paint rooms to freshen up or brighten up your home. Paint your front door, garage door, exterior and trim. Replace house numbers with new and attractive lettering. Replace burned out light bulbs or outdated fixtures. Replace broken or outdated appliances. Re-caulk bathrooms and kitchen area. Fix broken locks, doors, sliders, screens, etc.

Home must shine - inside and out

Vacuum, clean or replace carpets or rugs. Dust the furniture, mop floors, wash windows and clean blinds. Display new or like-new kitchen and bath towels, blankets and bedspreads. Use air fresheners if necessary. Exterior areas must be cleaned too, no cobwebs. Replace welcome mats.

Consider home’s curb appeal

Mow the lawn, rake the leaves, remove snow, etc. Trim all hedges or trees and replace dead or unattractive plants. Plant flowers, add stone accents and mulch planters. Make the home more appealing from the street. Replace the mailbox if old, rusted, or dented.

Staging

Arrange furniture to showcase each room. Rooms should feel spacious. Adjust window shades and blinds to allow natural light into the rooms. Kitchen and Bathrooms must be spotless. Clean out medicine cabinets and vanities. Display fresh flower arrangements in dining or kitchen area. Make it a model home.

Showtime

Allow your Realtor® to show your home during weekdays & weekends. Serious buyers look every day of the week, not just on the weekends. Maintain the cleanliness and appearance of your home on a daily basis. Keep promotional flyers on the kitchen counter. Allow your Realtor® and buyer’s agent to field all questions from potential buyers.

Financial Resources

Search Homes & Agents

Search Homes & Agents