Special Offer on ADT Home Security

Things to Consider When Building a Home

Where to start

Unless you have extensive experience in home building and a lot of cash, you’ll be hiring a builder to construct your new home and you’ll need to obtain a construction loan. Identify a professional contractor and a reputable construction lender, both agreeing to your project details, your time line and all home specifications and you’ll have the home of your dreams.

Formulate a plan and execute it

If you’ve never contracted with a builder before, the prospect of working through the process can be very intimidating. Custom homes require you to work through many details and make many decisions. If you’ve done your homework, building your custom home is very satisfying. From landscaping to rooftop, the work of art and labor of love will be yours.

Pulling your team together

Make sure your home builder and lender are reputable. Ask for references, check to make sure they are properly licensed and review their ratings online with sites like the BBB and state division of professional registration. A good rule of thumb is ensuring your builder and lender have been in business for a minimum of 5 years. Better Business Bureau: www.bbb.org

Verify proper insurance and bonding

Make sure your builder has sufficient worker’s compensation and general liability insurance. If not, you may be liable for any construction-related accidents on your premises. Most builders are bonded. Before work commences on your site, verify their coverage, or get permission to obtain verification of coverage directly from the builder’s insurance agent.

Review your contract and warranty and seek advice

Make sure your builder provides a complete and clearly written contract. The contract will benefit both of you. Ask in advance to review your home warranty to verify all warranty coverage you’ll have upon completion. Consider hiring a real estate attorney to review your contract, and an engineer/project manager to oversee your construction project. An experienced representative can spot and deal with problems as the home is built.

Schedule a final walk-through before final payment

Make sure your builder and lender agree that the final disbursement to the builder will occur when the home is 100% complete, is move-in ready and you’ve conducted a satisfactory walk-thru. All components of the home must be working correctly. A “punch-list” to correct deficiencies must be in writing. Work should be completed within 30 days of the walk-thru.

Home Ideas Gallery

Mortgage Calculator

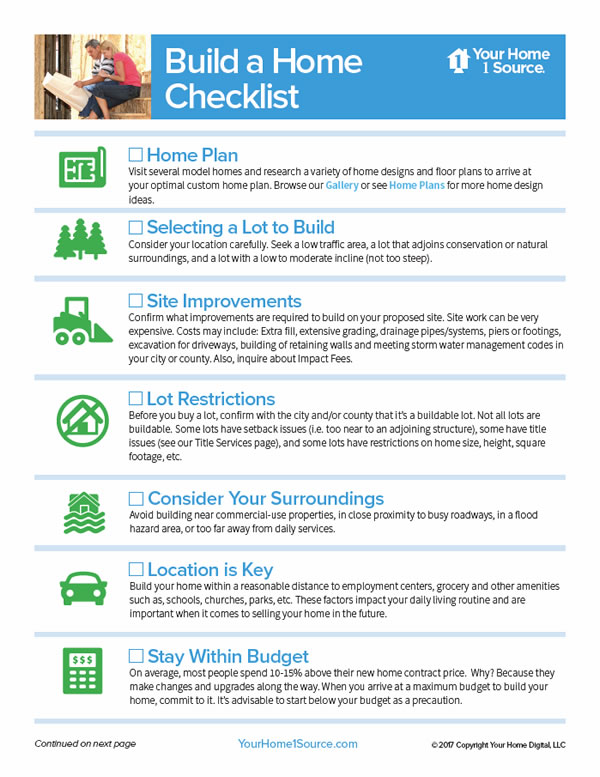

Checklists

Articles on Building a Home

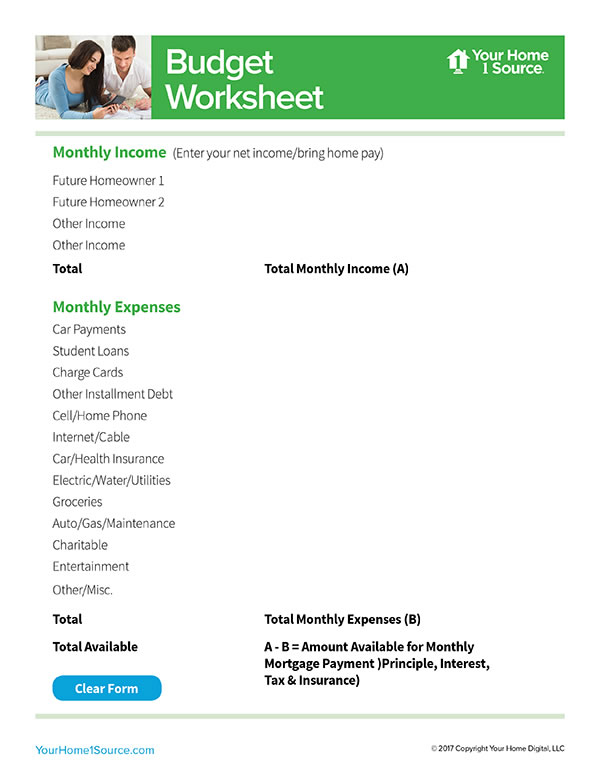

Financial Resources

Find Builders

Find Builders