Preparing to Buy a Home

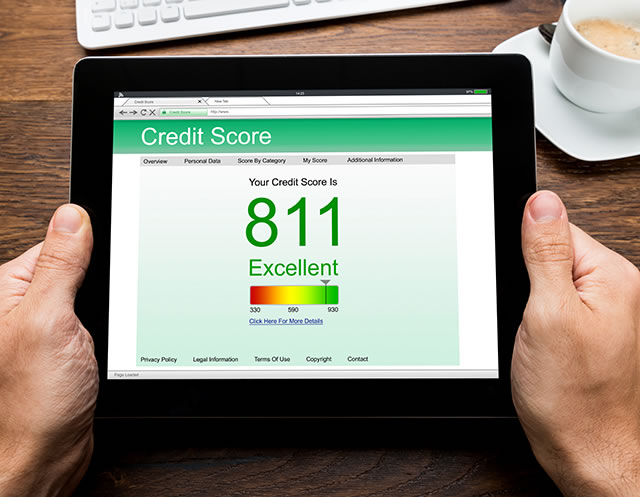

Order Your FREE Credit Report

Federal law allows you to obtain a free copy of your credit report every 12 months. Go to AnnualCreditReport.com to obtain your tri-merged credit report from TransUnion, Equifax and Experian. This important step allows you to obtain your credit scores and view your credit history as reported by creditors. Also find these tools: All about credit reports, Frequently asked questions and Protect your identity.

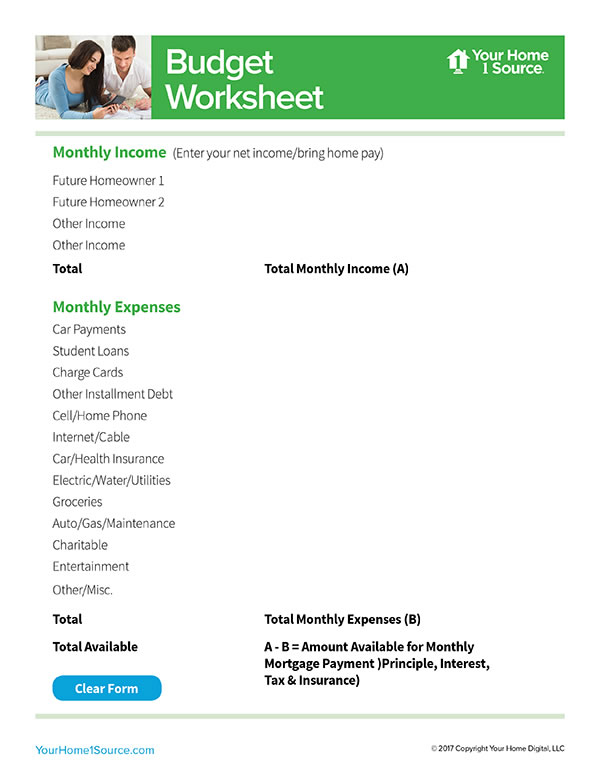

Review Your Monthly Budget

Before looking at real estate ads or visiting open houses with a real estate agent, take time to complete our Budget Worksheet. Calculate your actual net income and monthly expenses, then determine your maximum monthly mortgage payment. Use our Mortgage Calculator to figure monthly payments. If the property you’re considering has Home Owners’ Association (HOA) fees for common areas, pool, golf or maintenance, add the HOA fee to your budget.

Don’t Over-Spend on a Home

It’s tempting to compare the homes of your friends, family or co-workers, but this is your home and you will be making the mortgage payments. Don’t be pressured to buy a home above your financial means. Focus on your practical needs and personal circumstances. Your income, job stability, monthly expenses and available cash should dictate your purchase price range.

Consider Other Home Expenses

You will have additional monthly expenses for your home. Real estate taxes, homeowner’s insurance, or HOA (Home Owner’s Association) fees. You also need to plan for maintenance expenses. Things break and wear out over time. Keep a savings account and budget monthly for future home maintenance.

Don’t be Mortgage Poor

Leave room in your budget for investments and for your retirement. Remember the saying, "don’t be mortgage poor". It’s also wise to have money for entertainment, travel and recreation. Manage your home expenses or your home expenses may manage your lifestyle.

Start Financial Planning Now

When you buy a home, future home repairs must be considered, but it’s also prudent to invest monthly for other needs. The cost of raising children, continued education or training, retirement, healthcare, travel and more. These are all areas that require careful planning. Work with a reputable financial planner and get started. Be wise and be disciplined.

Mortgage Calculator

Articles on Budget/Plan to Buy

Financial Resources

Changing How America

Overcomes Financial Challenges

Balancing Income and Expenses

Repaying Credit Card Debt

Buying Your Home

Understanding Your Credit Report

Avoiding Home Foreclosure

Recovering from a Natural Disaster

Reverse Mortgage Counseling

SHARE THIS PAGE