CURRENT MORTGAGE RATES

Optimal Blue provides the most comprehensive, accurate, timely, and interactive analysis of pricing ever conducted in the mortgage industry. Calculated from actual locked rates with consumers across more than 30% of all mortgage transactions closed nationwide, Optimal Blue provides multiple mortgage pricing indices developed around the most popular mortgage loan products and specific borrower attributes.

How to shop for a home loan

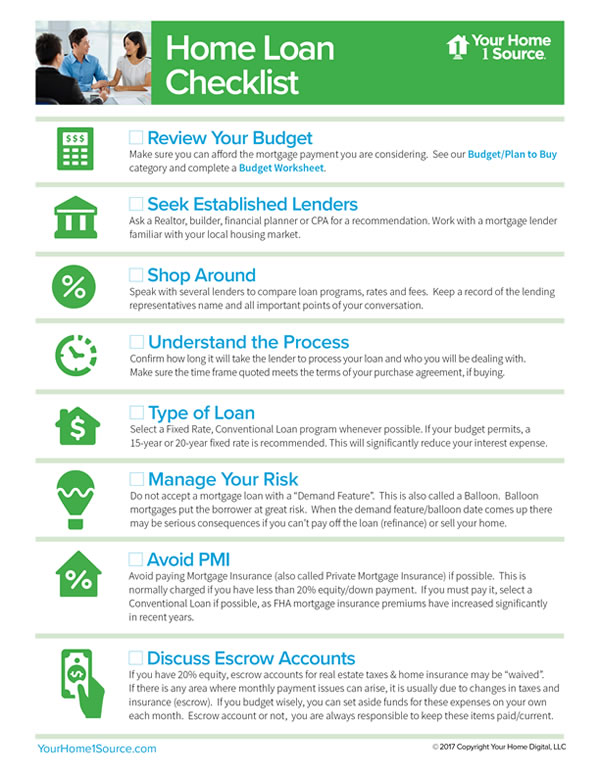

Who to Contact

It’s always best to work with a recommended lender. Do some research. Ask a trusted advisor or close friend. Financial institutions and mortgage banking companies are usually good sources for home loans. Your lender should be experienced, know the local market and have a solid reputation. Select the most knowledgeable, friendly and responsive lender – and a lender you believe you can trust.

Perform Due Diligence

After speaking to prospective lenders, perform due diligence. The NMLS may be a good place to start. NMLS stands for Nationwide Mortgage Licensing System. The NMLS regulates U.S. residential lenders. Each registered Mortgage Loan Originator (MLO) has a unique identifier number on their business card and website. Search the NMLS for their history. The Better Business Bureau also lists any complaints.

Keep All Email Communication

A common problem when obtaining a home loan is miscommunication. Make sure that you discuss the specifics of your loan request with your lender through email if possible and keep your email history. Your earnings, employment history, credit scores, verified assets for down payment, closing cost figures and information about the property – these are all critical details. You must be honest in all details, and so must your lender. If there are issues your email history could be vital and help resolve the problem.

Ask Questions, Get Facts in Writing

Confirm your loan program, interest rate, rate lock-in period, closing costs and other details in writing. Underwriting standards have tightened in recent years and vary with each lender. More regulations and disclosures have impacted the process. Allow 30-45 days from loan application to loan closing. If someone quotes you 2 weeks to process and close your loan, they may be over-promising. Proceed with caution. Carefully review your Mortgage Loan Disclosure Statement and Closing Disclosure – as these are key documents.

Loan Terms, Timelines Must Match Purchase/Sale Agreement

Verify that your lender can meet your financing contingencies and closing date. If you need a 96.5% FHA loan (3.5% down) and you need to close in 40 days, but the lender does not offer FHA loans and requires 60 days to close, that’s a problem. If you’re buying a home from a builder and you need a 180-day rate lock-in (to protect current low rates during construction) then you’ll need a lender that offers extended rate lock programs.

Avoid Loans with Pre-payment Penalties

Make sure the initial Loan Estimate and final Closing Disclosure provided by your lender clearly state that there is no pre-payment penalty on your loan. You should have the option to pay a portion of the balance or pay the entire balance early without penalty.

Adjustable Rate Mortgages

Adjustable Rate Mortgages (ARM’s): Unless you are comfortable with potential rate increases in the future, consider a fixed rate mortgage. If you will own your home for a short period (i.e. 2-3 years due to a military assignment or a shortterm corporate relocation), an ARM loan could be a favorable option to obtain a lower rate for the short-term stay. Even then, ARM loans are a higher risk financing option.

Balloon Mortgages and Risky Terms

Avoid loans with a Demand Feature. This means the loan will come due or mature at some future date. These programs are often called "balloon mortgages". While balloon mortgages are taboo under the Dodd-Frank Financial Reform Bill and QM (Qualified Mortgage) guidelines for owner-occupied homes, some small banks offer these products as "Portfolio Loans", not subject to all federal guides. Don’t accept a balloon mortgage unless you have the cash to pay off the loan.

Mortgage Insurance

Avoid loans with Mortgage Insurance (also called MI, PMI or MIP) if possible. Mortgage Insurance protects the lender in case you default. Don’t get this confused with Credit Life Insurance, which may pay off the loan in the event of death of a borrower. Mortgage Insurance is required on FHA loans, or Conventional loans with less than 20% down payment (equity). If you must pay Mortgage Insurance, select a Conventional Loan if possible (i.e. Fannie Mae), as the monthly MI premium may be removed in the future when your loan balance is paid down, and timely payments have been made.

Escrow Accounts for Real Estate Taxes and Home Insurance

You may be required by your lender to pay into an escrow account for real estate taxes and homeowner’s insurance. The escrow is collected with your monthly principal & interest payment. Unless your loan plan requires this (as with FHA loans), you may want to pay these expenses on your own. If you have 20% down (or 20% equity in your property is the case of a refinance loan), you should have the option to pay taxes and insurance expenses separately. This is commonly called an "escrow waiver".

Mortgage Calculator

Checklists

Articles on Home Loans

Financial Resources